What We Handle for You

등록부터 분기별 신고까지, 우리가 모두 처리해 드립니다.

등록 설정

Autoónomo 등록(Modelo 036/037 + RETA – 월간 사회보장)

일일 관리

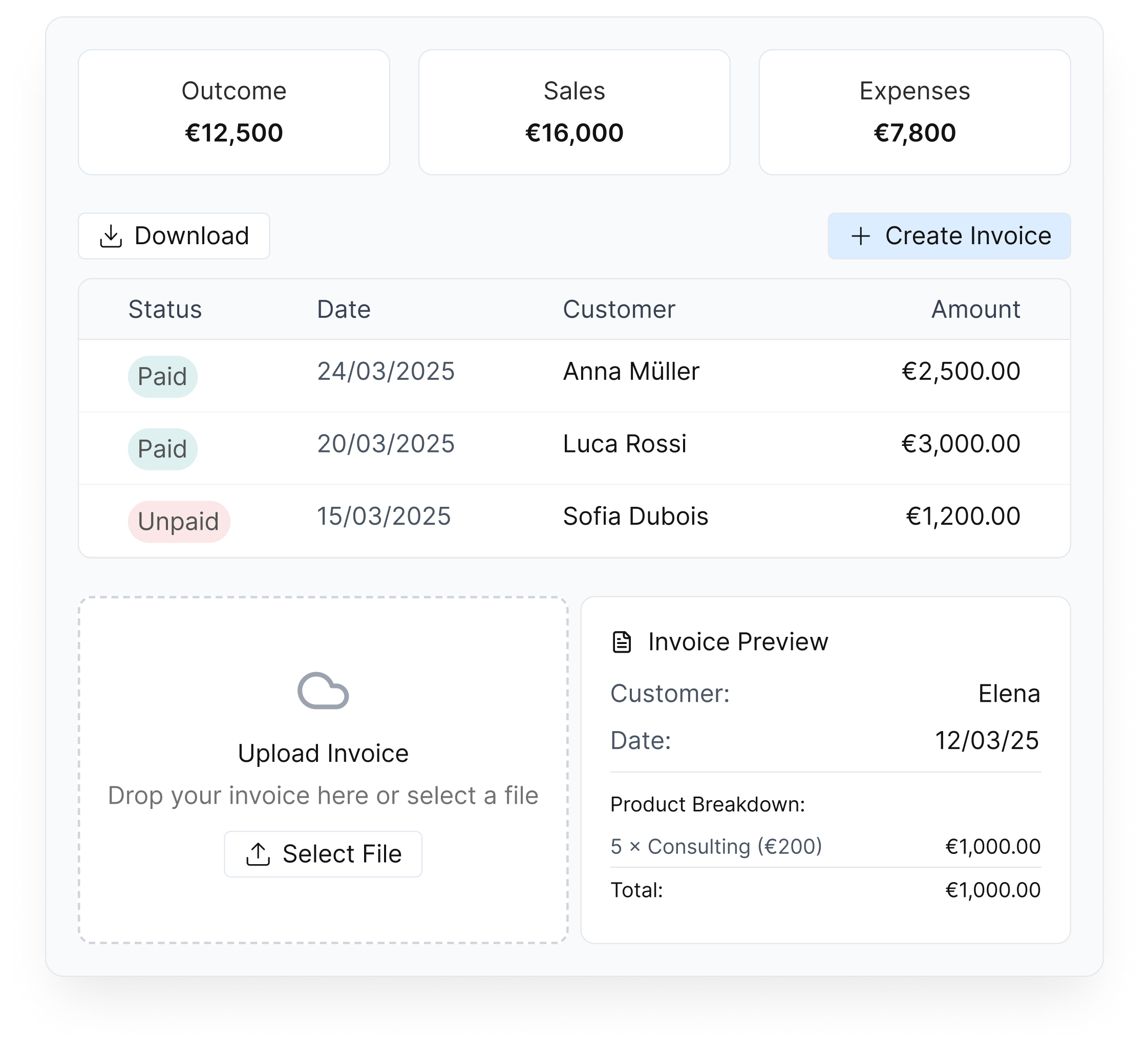

회계, 송장 도구 및 비용 분류 - 모두 세금 신고에 적합

정기 신고

세금 신고: Modelo 130(IRPF) + Modelo 303(VAT)

연말 신고

연말 신고: Modelo 100(소득세) + Modelo 390(부가가치세 요약)

특별 서비스

디지털 인증서, DTA 조언(이중 과세 방지), Beckham Law, 다국어 지원