What We Handle for You

登録から四半期ごとの申告まで、すべてお任せください

登録設定

Autonomo 登録 (Modelo 036/037 + RETA – 毎月の社会保障)

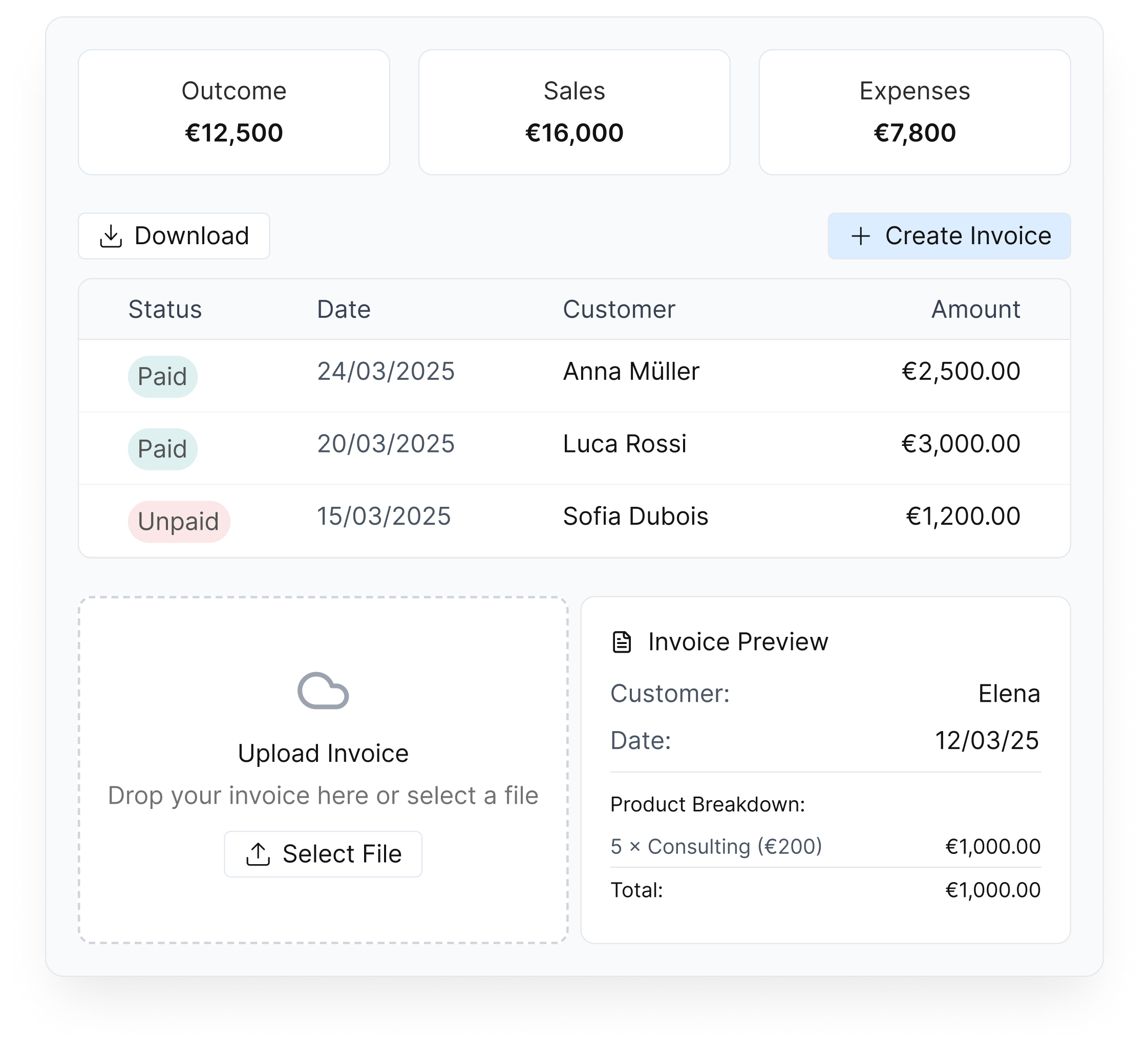

日常管理

簿記、請求書ツール、経費分類など、税務申告に必要な機能がすべて揃っています

定期的な提出

税金申告: Modelo 130 (IRPF) + Modelo 303 (VAT)

年末申告

年末申告: Modelo 100 (所得税) + Modelo 390 (VAT概要)

特別サービス

デジタル証明書、DTAアドバイス(二重課税回避)、ベッカム法律事務所、多言語サポート