Why Choose InnoTaxes?

Common frustration

How InnoTaxes solves it

Don't understand Spanish tax rules

We explain everything in your language: English, Spanish, Japanese, Korean, Russian and Chinese.

Missed deadlines or unexpected fines

You get a personal tax calendar with automated deadline alerts

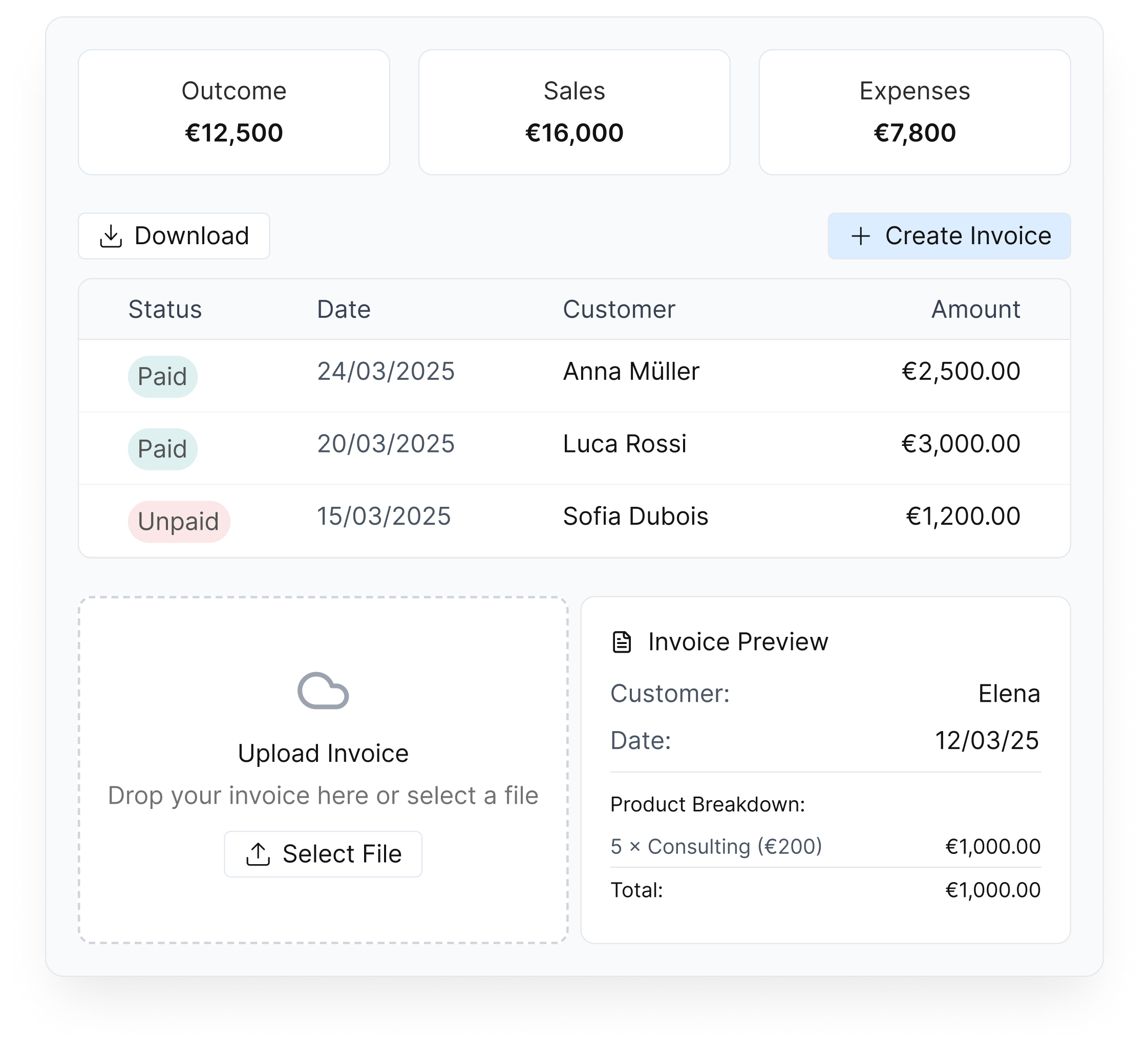

Confusing reports or cryptic PDFs

Our dashboard gives you real-time visibility into your finances

No idea why certain filings were made

We explain the how and why behind every accounting and tax decision

Previous gestoría made errors

We audit your past filings and fix compliance risks before Hacienda finds them

Need help with international or cross-border tax issues

We optimize your Spanish and global tax obligations — not just local filings